SV Short-Term

Note I

This note offers a target annual return of 10% with a 1 year term. Supervest’s Short-Term Note strives to enable investors to grow their investment opportunities on our platform.

Supervest offers direct access to investment opportunities

within the Small Business Finance asset class to retail

investors and financial advisors.

Since inception,

Supervest users

have funded

Individual Merchant

deals on

the platform

Supervest users

have invested

on the platform

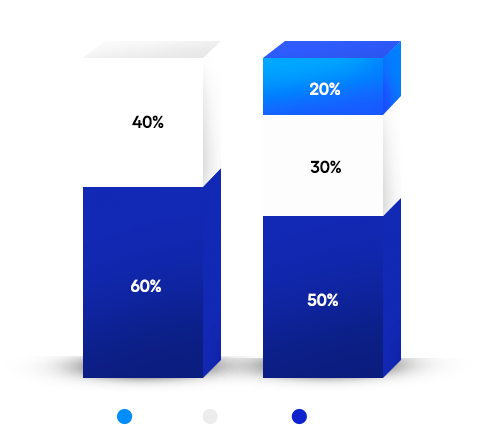

For years, retail investors have heard the 60/40 portfolio has needed to be rebalanced; however, access to alternatives was limited to the ultra-wealthy and institutions.

In a world marked by volatility and fluctuating yields, a new portfolio is needed.

Adding non-stock market correlated alternative investments to your portfolio can help generate passive income, boost yield, and add asset diversification.

Since inception, Supervest users have funded over $900M+ across 38,000 individual merchant deals on the platform.

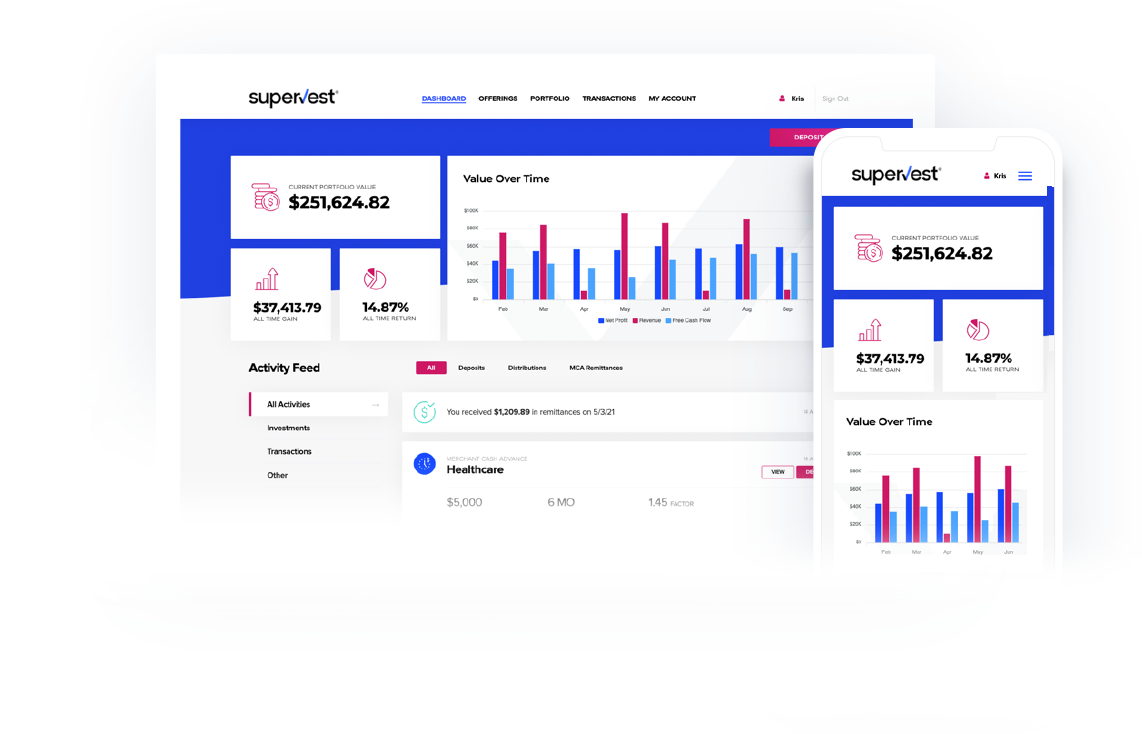

Our premiere investment experience means you

always have access to the full power of Supervest

at your fingertips. From account creation to browsing

investments, our users experience a transparent

& easily accessible platform.

With a diverse selection of investment opportunities available, Supervest users can make informed decisions

to build their portfolio and diversify as much (or as little) as they want!

Supervest’s team of investment professionals to review

and analyze every investment opportunity offered

Whether your goal is diversification, generating income,

value growth, or a combination of all three, Supervest’s

investment offerings can help.