It’s been highlighted that the merchant cash advance (MCA) industry has shown promising growth and innovation in the first quarter of 2023, despite economic uncertainty and the recent regional banking crisis. The industry has been offering businesses quick, flexible funding options, often using advanced technology to streamline the application process and improve underwriting. One of the key trends in the MCA market has been the increased use of artificial intelligence and machine learning algorithms to assess creditworthiness and mitigate risk, resulting in faster approval times and more accurate underwriting. However, concerns remain about the potential risks associated with MCA financing, and industry groups and regulators are calling for increased transparency and better consumer protections to balance access to credit for small businesses and protection against predatory lending practices.

Market Review

The merchant cash advance (MCA) industry has continued to see growth and innovation over the first three months of 2023. Despite ongoing economic uncertainty and the recent regional banking crisis. MCA providers have continued to offer businesses access to quick, flexible funding options during a time of great uncertainty for many small and medium-sized businesses (SMBs).

One trend that has emerged in the MCA market is the increased use of technology to streamline the application process and improve underwriting. Many providers are using artificial intelligence and machine learning algorithms to assess creditworthiness and mitigate risk. This has allowed for faster approval times and more accurate underwriting, which has in turn increased the overall efficiency of the industry.

Another impactful event in the MCA market is the knock-on effects of the current regional banking crisis. The sudden pullback of banks and their ability to finance businesses working capital needs for the foreseeable future has forced SMBs to explore alternative funding models, such as revenue-based financing and invoice factoring. These models offer businesses more flexibility in terms of repayment and can be particularly attractive to businesses with irregular cash flow. However, they can also come with higher costs and fees, so businesses should carefully weigh their options before choosing a funding model.

Overall, the MCA market has continued to see strong demand from small and medium-sized businesses looking for quick, flexible funding options, especially in the current banking environment this is particularly true for businesses that have been adversely affected by the current crisis or who have seen their current banks be taken over by government regulators. Many MCA providers have responded to this demand by expanding their offerings and increasing the size of their funding pools.

However, there are also concerns about the potential risks associated with MCA financing. Critics argue that the high costs and fees associated with MCA loans can lead to a cycle of debt for businesses that may ultimately be unsustainable. Additionally, some MCA providers have been accused of using aggressive sales tactics and engaging in predatory lending practices.

To address these concerns, industry groups and regulators have called for increased transparency and better consumer protections in the MCA market. Some states have also introduced legislation to regulate the industry and protect small business borrowers. As the MCA market continues to grow and evolve, it will be important for both providers and regulators to strike a balance between ensuring access to credit for small businesses and protecting consumers from predatory lending practices.

In conclusion, the MCA market has continued to see growth and innovation over the first three months of 2023. The current banking crisis has created an opportunity set in the industry reminiscent of the favorable environment coming out of the great recession in 2009. The industry has responded to the ongoing challenges of the banking crisis by offering businesses quick, flexible funding options, often using advanced technology to streamline the application process and improve underwriting. However, there are also concerns about the potential risks associated with MCA financing, and it will be important for both providers and regulators to work together to ensure that small businesses have access to credit while also being protected from predatory lending practices.

Sector Facts

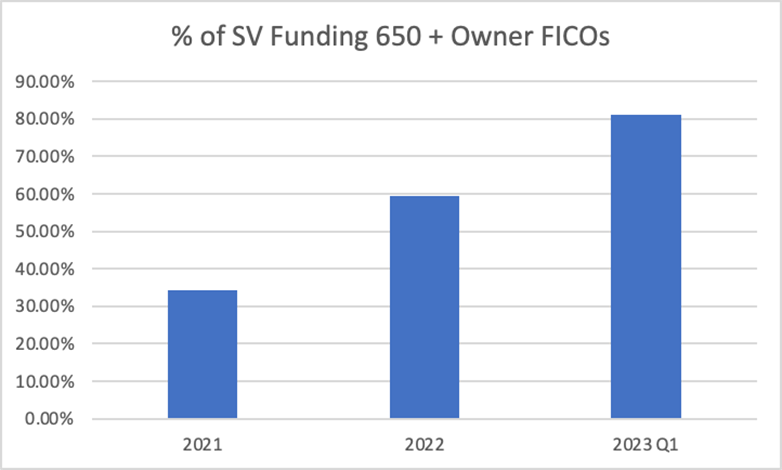

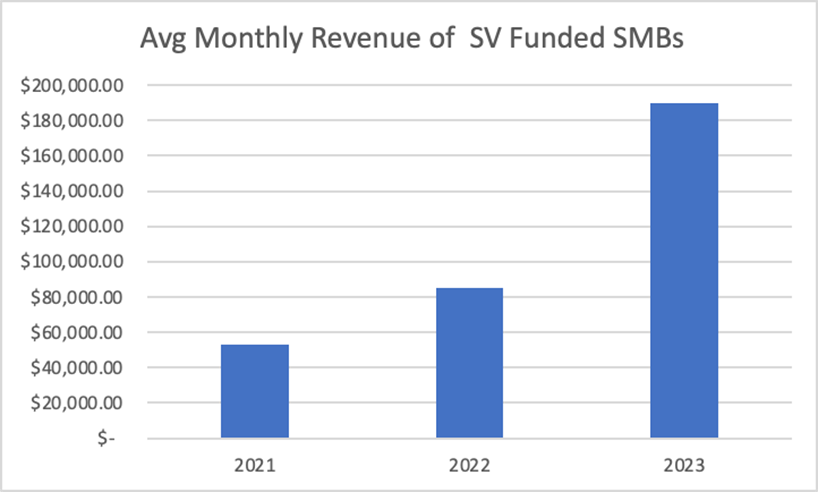

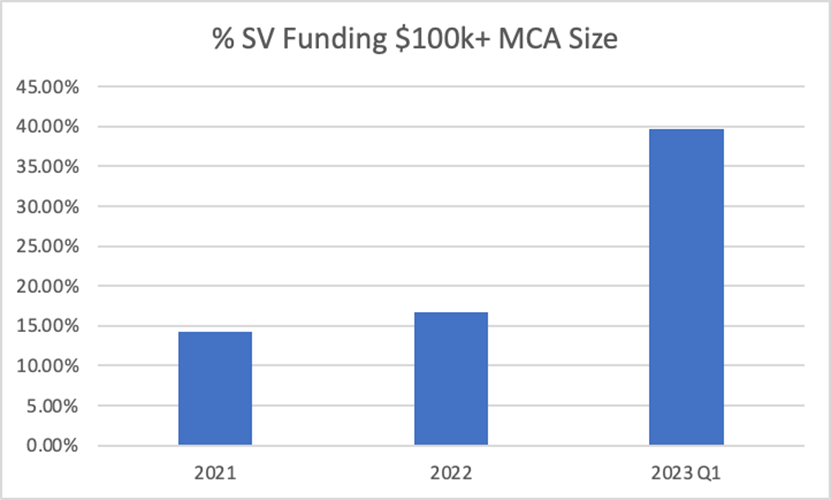

Similar to the trends that affected the MCA space as a result of the housing crisis and fallout from 2008 – 2010, looming fears of a recession and the recent shakeup in the banking sector have led to a credit crunch reducing access to capital for many SMBs. The impact on the MCA industry is majority positive, where the pool of applicants in need of working capital moves upstream, demonstrated by an increase in credit scores, and revenues of the underlying business. and total amounts being funded.

An increased concentration of funding into the higher end of these variables is evident in the trends over the past 2+ years with a sizeable spike in 2022 Q4:

The recent sizeable increase across all three attributes of the underlying MCA submissions points directly to this “upstream” movement of the customer base for SV Funding partners and bodes well for performance going forward. Since 2021, historical performance for $100k+ MCA submissions has demonstrated a sub-10 % default rate with the potential to yield 18% – 22% cash on cash returns to investors on an annual basis. Continuing to solidify a sizeable portion of the portfolio in this sector, while remaining diversified as a whole, projects to increase returns to investors and expand investment into Supervest in 2023.

Perspective & Outlook

As the first quarter of 2023 comes to a close, the global economy and stock markets have experienced a mix of trends and challenges. The world continues to grapple with the ongoing impacts of the COVID-19 pandemic, geopolitical tensions, and the recent shock to our banking institutions.

One of the key economic trends in the first quarter of 2023 has been the continuation of strong global growth, driven in part by increasing vaccine rollouts and the reopening of economies. Many countries have seen a surge in consumer spending and business investment, particularly in sectors such as technology, healthcare, and renewable energy.

However, this growth has also been accompanied by concerns over inflation, as rising prices for commodities, energy, and other goods and services have put pressure on businesses and consumers. Central banks in many countries have responded by tightening monetary policy, raising interest rates, and scaling back quantitative easing programs. The result is certainly partially to blame for the current turmoil in the regional banking industry.

Another trend in the first quarter of 2023 has been increased volatility in stock markets. Despite the strong economic growth, many investors have grown cautious about the potential impact of inflation and rising interest rates on corporate profits and valuations. This has led to sharp swings in equity markets, with some sectors outperforming and others struggling.

Technology stocks have continued to be a key driver of market performance after a severe swoon in 2022. The renewable energy sector has also seen strong growth, as governments and businesses invest in clean energy infrastructure and decarbonization efforts.

However, there have also been challenges in some sectors, particularly in traditional industries such as manufacturing, energy, and retail. These sectors have faced headwinds from rising input costs, supply chain disruptions, and changing consumer preferences.

In addition to these economic and market trends, the first quarter of 2023 has also seen a number of geopolitical developments that have impacted global markets. The ongoing tensions between the United States and China over trade, technology, and human rights have continued to shape the global economic landscape, while the crisis in Ukraine and the conflict in the Middle East have raised concerns about energy security and geopolitical stability.

Overall, the first quarter of 2023 has been marked by a mix of opportunities and challenges for investors and businesses alike. While global growth has remained strong, inflation, interest rate, and banking crisis concerns have created uncertainty and volatility in equity markets. Technology and renewable energy sectors have continued to drive market performance, while traditional industries have faced headwinds. Geopolitical tensions and crises have also added to the complexity of the economic landscape, creating new risks and opportunities for investors to navigate.