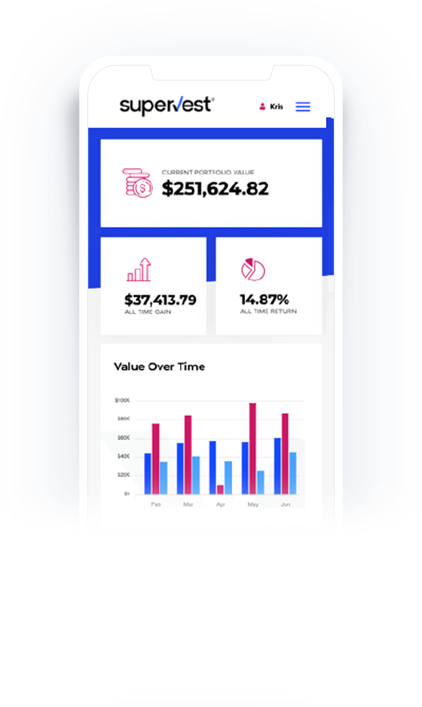

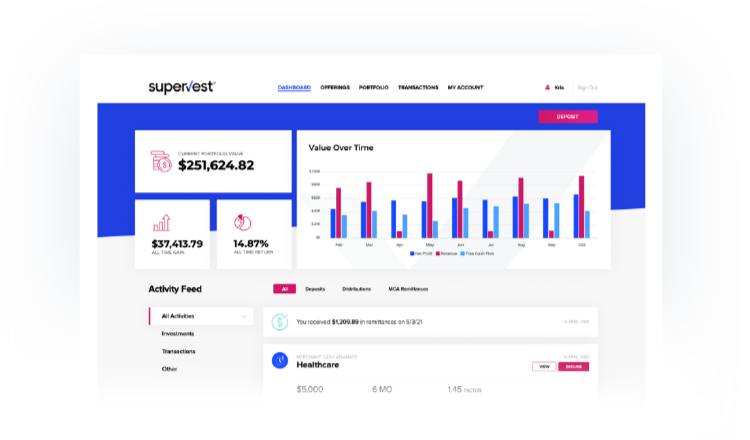

At Supervest, we've designed our offerings to serve as complementary, diversifying investments for traditional 60/40 portfolios. With a range of note terms from 1 to 3 years, and flexible distribution options — monthly, quarterly, or end-of-term payouts — we provide investors with the flexibility to tailor their investments to their time horizon and preferred payment structure.

Our platform allows investors to allocate capital across multiple note offerings within a single account, creating a customized and diversified strategy to meet their unique financial goals.

show more