For investors born between 1965 and 1979, your personal finance goals might look a bit different to everyone else’s—from covering a child’s college tuition to planning a phased retirement.

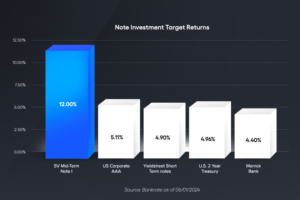

The SV Mid-Term Note I includes features that can support these kinds of financial milestones.

In this article, we’ll explore how Note I’s income, flexible redemption options, and balanced portfolio management can make it a potentially attractive option for Generation X investors.

How Can Supervest’s Note I Meet My Needs?

1. Consistent Quarterly Income

With the SV Mid-Term Note I, you could receive quarterly payments of 3%, which can be a helpful way to support your cash flow for everyday expenses.

Imagine Lisa, a 54-year-old lawyer preparing to scale back her work hours. The quarterly payouts from her Note I investment can give her a reliable income stream, which allows Lisa to reduce her caseload without feeling financially strained.

This gradual transition can help Lisa balance work and family while also maintaining her financial goals.

2. Flexible Redemption Options

The SV Mid-Term Note I has just a two-year lock-up period. After that, you can either redeem your investment or roll it over.

This flexibility can be useful for Generation X investors with big plans on the horizon. Like helping cover a child’s college tuition, upgrading the home, or supporting a parent’s medical needs.

These goals are top priorities for many Gen Xers, and you might have more than one of them on your mind. That’s why having access to your capital after two years can offer valuable flexibility as your priorities shift over time.

3. Built-In Security with a Managed Portfolio

The Note I is backed by a well-diversified portfolio of Merchant Cash Advances (MCAs). But how do we balance risk?

- Diversified Approach: No more than 1% of the principal goes into any single MCA, helping to spread risk across multiple investments.

- Experienced Management: Our experienced team carefully manages each investment.

- Since 2021, Supervest has carefully invested more than $8,500,000

- Success Rate: To date, our notes have achieved a 100% success rate in delivering target returns.

What Can Generation X Investors Do Next?

For Gen Xers looking to balance income and growth, the SV Mid-Term Note I could be worth considering. Create a free investor account to get started today, or to explore our other notes.

And don’t forget: if you refer a friend to Supervest, you’ll receive a one-on-one meeting with our very own Chief Investment Officer to review your portfolio.